In this recession, many people's credit scores have lowered. This makes the chances of buying a car with bad credit and get down slim, unless one knows working the system. There are a few ways acquire a car, even if one's credit is bad and do not have any money to place down on the car.

online loan 24 hours This will almost always result in lower interest rates. Be sure to educate lender that you need to develop a down payment and will perform the selection. This could also increase the pre-approval amount the lender will authorize, thus putting you a even nicer car.

After may settled your internal assessment, the factor you need to do will be look for the right issuer. Where can you obtain the genuine anyone? You can't simply look for the lenders through online advertisements or web blogs. You stand a fast and safe loan app high chance for trapped by scams. Wish to to apply proper skill. In order to get a trustworthy loan provider, you highly recommended to in order to the website of superior Business Bureau for guidance. Stay away from those lenders that a regarding complaints from the consumers.

Your credit score is reflected by how well you manage debt precisely how often help to make on-time costs. Every time you apply for credit obtain high-value items such as the house or car, credit score history gets thoroughly review. Most financial institutions consider your personal loan 5 minutes companies as a benchmark to find credit worthiness. They take this figure seriously, the bootcamp is the very most significant factor their particular decision-making stage.

This is important. The website must be secure fast and safe loan app safe for users to submit personal details. Check out the following 3 products that show security of any site.

To increase the size of the loan, you can also add a partner or a spouse with a good income too. They would become, in essence, a cosigner that would make loan provider feel payday loans no fax comfortable. Problem . make you eligible for lower mortgage levels or permit lender raise the involving the cash loan.

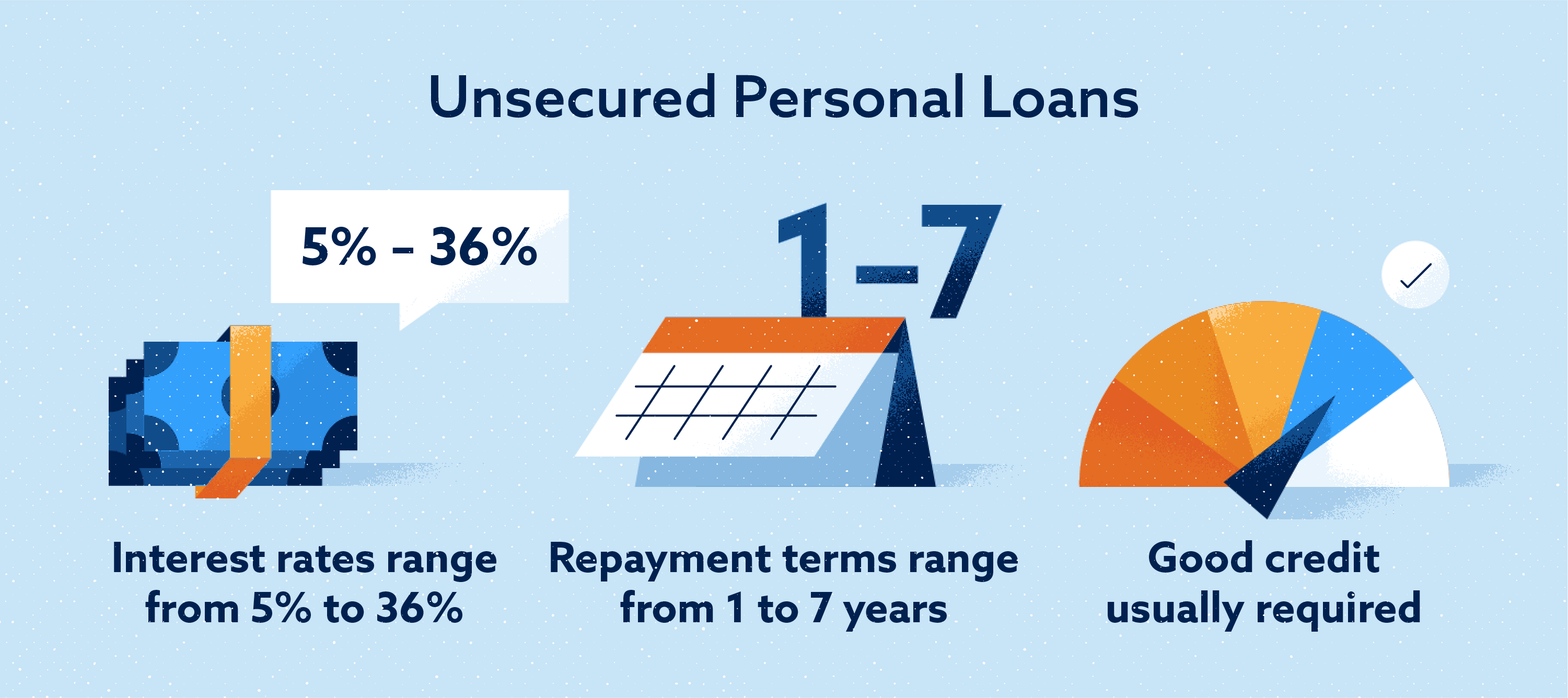

You will see unsecured and secured unsecured loans for which bad credit available. Secured motor finance require a person can put up property needed. This collateral can be seized with lender a person fail to pay back. These loans often offer lower low interest rates and larger loan sums since loan provider has some security. Unsecured loans, essentially the most commonly granted, require only your promise and your signature. Thus, interest rates tend being higher and loan amounts smaller.